(There was no Class 22 due to CMU Carnival days.)

It seems that most of the press coverage that startups receive is around funding events – seed rounds, series A/B/C, IPOs, acquisitions… But this is entirely disproportionate to the actual work done and value created by those organizations.

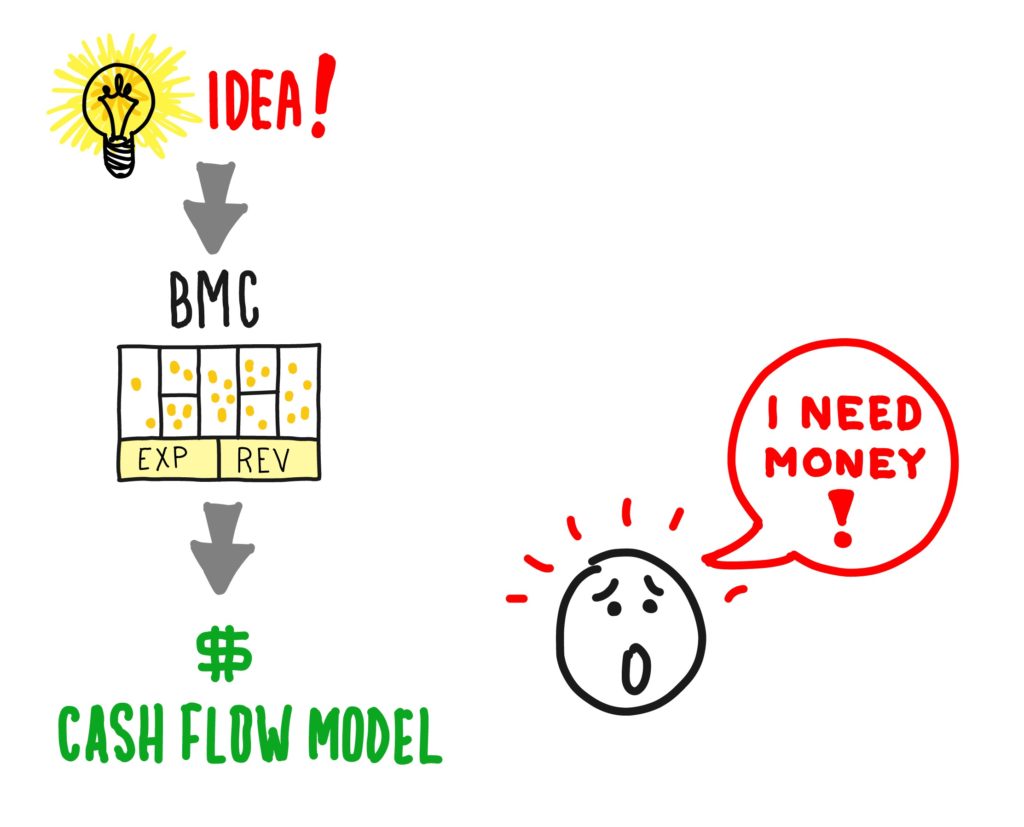

This class on funding your company happens late in the semester for a reason. Without understanding your product, your customers, and your business model, you can’t begin to understand what your funding needs are.

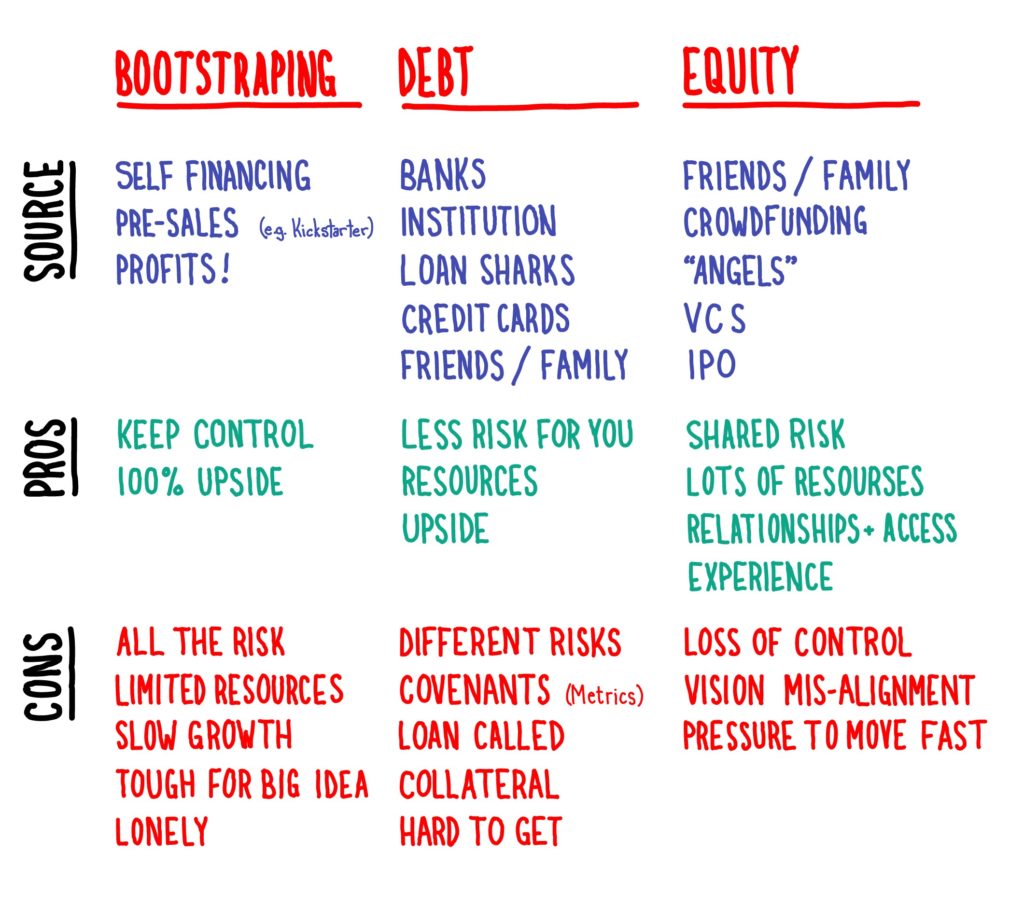

Once you understand your needs, you can strategize about the best way to fund your company. There are three primary funding sources – through profits, by borrowing money, and by selling equity in your company.

Bootstrapping is a viable option if you can reach profitability quickly and don’t need a large influx of cash or are planning to grow slowly. Debt financing is a common tool used by most companies (and individuals!), but lenders are highly risk adverse. To obtain a reasonable loan rate, you need to already have a viable business going and provide adequate collateral or guarantees.

Equity funding is commonly used to raise capital for startups, regardless of size. Even bootstrapped companies use equity financing early on by the founders investing their own money and time in the company in exchange for an ownership stake.

All forms of equity financing are heavily regulated by the government as a way to protect both the investor and the company. You may only sell unregistered securities in the US (in this situation: non-public stock) to qualified investors. Qualified investors are either accredited investors (individuals who meet a minimum qualification of net worth and/or income) or institutions. (There are exceptions for crowdfunding if you are raising less that about $1M dollars, but you will have a large number of small investors.)

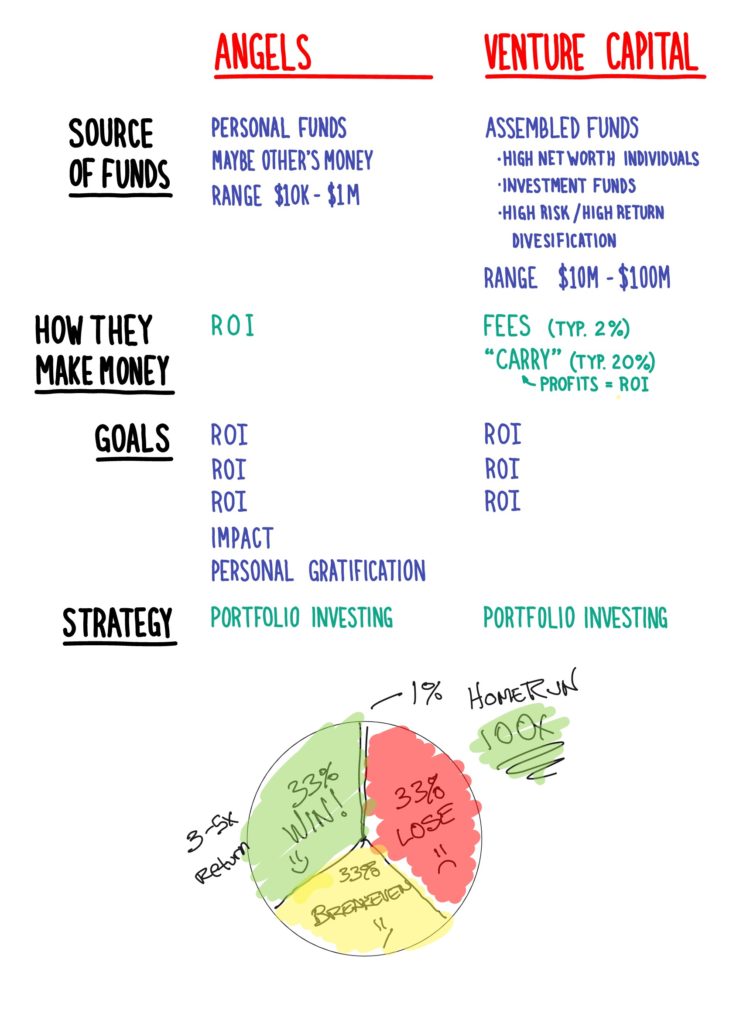

Individual accredited investors are commonly referred to as “angel investors”, or angels for short. They are investing their personal money, generally in the range of tens of thousands to a million dollars per investment. They are heavily motivated by the potential upside of their early investments, but may have other motivations that you will want to understand. Angels typically are very early investors in companies, and many times will network with each other to co-invest in opportunities that need more capital than they are able to invest individually. Some angels will manage a collective fund of individuals’ money and are referred to as “super angels.”

Venture capital firms raise funds from high net worth individuals, institutions, and investment funds. Their funds typically have a seven to ten year life span in which they must invest the money and allocate the returns back to their investors. VC funds range from small funds of tens of millions of dollars up to billion dollar funds. Because of the large size of the funds, they must make large investments (they don’t want to manage hundreds of small investments).

VCs and angels take a portfolio approach to their investments. They know that most of their deals will not be profitable, but a very small percentage will be a massive home run. They just don’t know which is which up front.

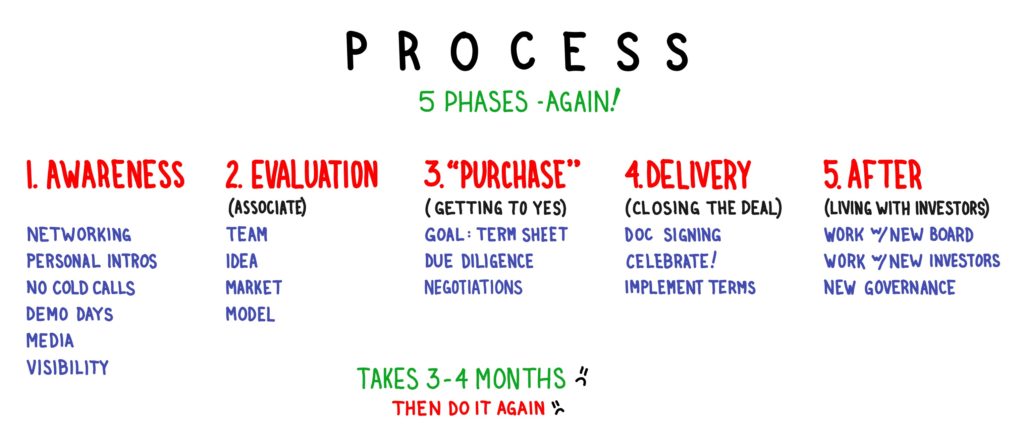

An investor is a customer – you are selling them something (equity in this case), and they are expecting a benefit from it (profit!). Consider the process of raising money as a sales process and follow the five phases we have talked about before. Raising money is a very high stakes sales activity, and will take devoted attention for a long period of time; time which is not spent on developing your actual product or customers. And for many fast growth companies, there is a short gap between raising a round of funding and beginning to raise a new round.

Professional investors will look at hundreds of potential investments for each investment that they eventually make. Expect a lot of nos before you get to a yes.

Hear it from the source! In this interview done at Stanford, Sam Altman (then the president of Y Combinator) interviews Marc Andreessen (VC), Ron Conway (super angel), and Parker Conrad (CEO) about fundraising. (4:45 Ron talking about what investors want, 16:00 Ron about deal flow in particular, but watch the whole thing.)

Once you have an interested investor you’ll negotiate a term sheet. DON’T DO THIS WITHOUT A LAWYER (in case you haven’t figured that out yet!). Regardless of the FACT that you have an excellent lawyer, you will want to understand all the terms in the deal and what they mean – it is you, not your lawyer, that needs to live with them for the rest of your career with the company.

Review from Class 15: Now in its fourth edition, Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist is the most complete resource available on preparing your company for professional investors.

There are also great resources for sample term sheets at the National Venture Capital Association (NVCA), Cooley, and Wilson Sonsini (both law firms).

Addendum

May 7, 2021. Jeffrey Bussgang, General Partner of Flybridge Capital, just shared this slide deck about raising money from VCs. Excellent information, right from the source.

Homework

By Wednesday Noon

- 3 questions for Jason, emailed to me

By Monday 5pm

- Watch 3 videos from 2021 McGinnis Venture Competition Final Round Pitch – there are 11 to choose from

- Write up the following and email to me

- For each one, what did they do to capture your attention and keep your interest?

- For each one, what did they do that was distracting or made you lose confidence in them?

- For each one, what was the flow of the presentation? The slide titles are a good clue! Not specifics about the product, but what are they trying to communicate to the audience?

- For each one, if you were an investor in the audience, would you consider investing in their company? Why or why not?

- What part of the flow did all three have in common?

- Any other observations are welcome.